The Power of Saving

a little savings per day goes a long way

click below to see how much!

Featured Content

Your Journey begins here

One thing I learned that I want to share, if I had made a simple effort to save and understand the impact of that savings 15 years ago, I would have triple the amount saved today by simply making better small daily choices.

Why do I share this? Simple, it is never too late to start and when you understand the power you have to control your financial choices you become in control and open up doors you never thought possible.

Once I understood my mistakes, I changed, not by becoming a cheap skate, but more by understanding my choices and how they compound over time. As I changed my opportunities changed, instead of every dollar going to something I spent, I slowly changed that to move more dollars to things that pay me back or spend them on the things that matter. As I continue my journey more opportunities open up each day.

I want to help you start your journey to becoming Thrifty Rich by giving you the tools you need to begin. Find the ideas that inspire you, try them, and see what a difference they can make. Remember, being a good saver is a marathon that pays you back in years. That is the hard part. To get over that, just remember this, ask yourself where would you be today if you had changed five years ago, ten years ago. Now, do you want to have the same results ten years from now?

Achieving what you want is achievable if you can make small daily choices that matter.

“Successful saving is a game of small wins over a long period of time”

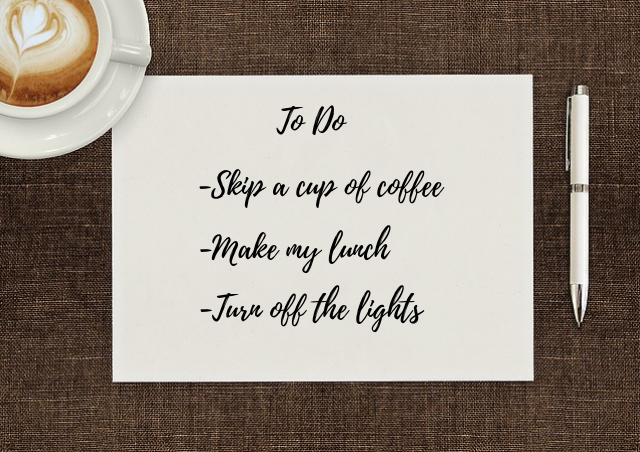

Save a cup of coffee $5

A coffee a day can easily add up to more than $155 a month or $1,800+ a year. Find days to either make coffee at home or skip it for something more healthy and log your savings!

Skip the soda $2

Skipping a soda as much as you can not only logs you $2 per day, but it is great for your health. Add to your savings and lose weight!

Bring your lunch to work $5-10

We know, it is easier to buy the $10 lunch at your local restaurant, but this single habit can cost you thousands per year. Figure out what you like, pre-make as much as you can and enjoy the savings.

Save on mortgage interest $20,000

One overlooked large savings can be achieved by simply sending an extra $50 per month to your mortgage payment. Over the life of the loan this could save you more than $20,000 in interest and reduce the number of months you actually pay.

Negotiate a lower interest rate

A simple call to your credit card companies can save you hundreds in interest rate charges. They typically have the power to lower you rates if you are in good standing. Make the call and save.

Switch out incandescents $.50

Each incandescent cost just under a penny an hour to run, a more efficient light bulb cost 1/6 of that. If you have 10 light bulbs running for 6 hours in a day your cost would be about $.50 vs. $.08 for modern bulbs. May be small but over the year it adds up, especially when you have more than 6 bulbs or leave them on overnight

A Daily Cup Of Starbucks Coffee Costs $167,000

You Have the Power to Change your Financial life, can you take that next step?

30 For 30 Rule

Why is saving so important? Can a few dollars a day really change things? Why should I put the effort in to save every day?

I get it, these are valid questions. I asked the same things. Here is what I am going to tell you, by the time you figure out the answer you have you have lost. For me, it means I could have retired at age 45 instead of my current path of some time over 60. It means financial freedom at any age, it means not living paycheck to paycheck. It means being able to do the things you want to do.

What it does not mean, fancy cars, yachts, and private jets. That takes a lot more effort, a bit of luck, and sacrifice. What I am talking about is having enough savings to cover expenses, having passive income that builds and supplements your income, and having financial security.

The younger you are, the more power you have and the smaller contributions have the largest impact.

Take, for example, a simple cup of coffee. I know many that buy one each day. That habit over the course of time costs $167,000. That is just one thing. If you are in your 20’s and can afford a cup of coffee a day, you can afford a rental property that will pay you in 15-20 years far more.

That may seem like a long time, but that time will come faster than you think and if you have done nothing it is hard to recover given the ups and downs of life.

As the rule above suggests, we can accumulate enough savings to reach one million dollars, but it does take effort. It does not mean that you have to sacrifice on everything, but knowing the impact of small purchases and their long term impact goes a long way.

So let’s quickly address the primary questions:

Why is saving important?

Here is a simple truth, it provides you more opportunities in the future then your current income can support. It also supplies you security from the chaos of life.

Can a few dollars really change things?

Yes depending on what you do with that savings and how consistent the savings are. Time is your friend, the longer you let it compound the greater impact it will have.

Why Should I put in the effort to save every day?

Simple, ask yourself where would you be now if you had a savings plan five years ago? 15 years ago? Savings over time will grow if invested. It is so much more than just the contributions.

Follow this blog and join our community to keep learning new ways to help you achieve your financial goals.

3 Starting Tips Help Start Reaching Your Financial Goals

Set Goals and Find Pictures For Them

What inspires you? A picture of your children, a vactation spot you want to go to, or maybe just a simple picture that brings you peace. It does not matter what you choose, put something visual to your goals, display it somewhere you can see it every day to remind you what you are saving for.

Small Saving Ideas, Big Rewards

You will be surprised at all the places we waste money. We all have friends and family that have terrific ways to save. Each person can have a unique way that you can save, embrace the ideas and see if it works for you. The key is to find the things that you can do. Something as simple as giving up a cup of premium coffee a day can get you $5 per day. Is your premium coffee worth $167,000?

Pay Yourself

The most important part of being Thrifty Rich is to pay yourself, in other words, take the money you save daily or weekly and move it to a savings or other account to set it aside for your more important goals. This is your reward for the smart daily choices you make.

How Much Can You Save?

A Little Savings Goes a Long Way

Save $5 a day

30-Year Return

$167,000

10-Years:$25,500

20-Years:$74,315

30-Years:$167,00

Save $10 A day

30-Year Return

$334,379

10-Years:$51,154

20-Years:$148,631

30-Years:$334,379

Save $20 A day

30-Year Return

$668,758

10-Years:$102,308

20-Years:$297,262

30-Years:$668,758

Save $30 A day

30-Year Return

$1,003,136

10-Years:$153,462

20-Years:$445,892

30-Years:$1,003,136

How I saved $168 in two weeks

How to save quickly and effectively

Some Money Ideas for 2019

Some ideas to invest $1,000 for 2019

Thrifty Rich Quick Start Guide

Here are some ways to make your money go further.